Do I Have to Pay Taxes on My Car Accident Settlement?

Whether you owe taxes on your personal injury settlement depends on the type of damages you receive. At both the federal and North Carolina state levels, economic and non-economic damages from a car accident are generally not taxable. This includes compensation for medical expenses, lost income resulting from your injuries, and pain and suffering. However, any interest earned on the settlement or punitive damages awarded is taxable. You typically do not need to report non-taxable portions of your settlement as income, but you should keep documentation in case the IRS requests verification.

Our skilled car accident lawyers at Rhine Law, P.C. will help you get the highest settlement possible – or litigate your case. Trust our team to manage all aspects of your claim, giving you peace of mind so you can focus on healing. In general, most of your settlement award will be untaxed.

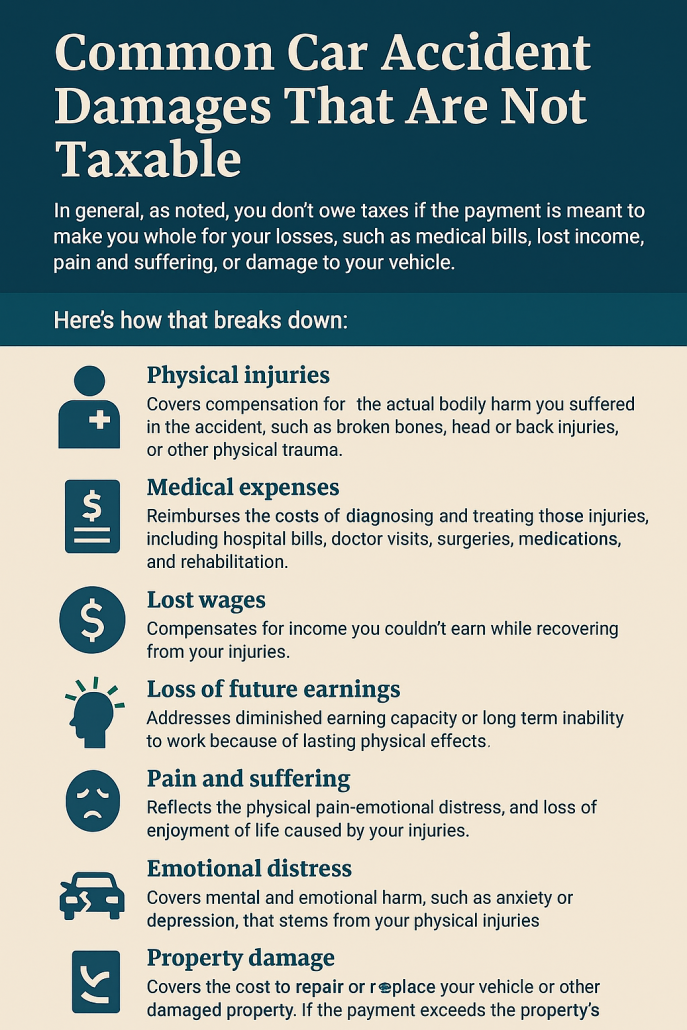

Common Car Accident Damages That Are Not Taxable

In general, as noted, you don’t owe taxes if the payment is meant to make you whole for your losses, such as medical bills, lost income, pain and suffering, or damage to your vehicle.

Here’s how that breaks down:

- Physical injuries: Covers compensation for the actual bodily harm you suffered in the accident, such as broken bones, head or back injuries, or other physical trauma.

- Medical expenses: Reimburses the costs of diagnosing and treating those injuries, including hospital bills, doctor visits, surgeries, medications, and rehabilitation.

- Lost wages: Compensates for income you couldn’t earn while recovering from your injuries.

- Loss of future earnings: Addresses diminished earning capacity or long-term inability to work because of lasting physical effects.

- Pain and suffering: Reflects the physical pain, emotional distress, and loss of enjoyment of life caused by your injuries.

- Emotional distress: Covers mental and emotional harm, such as anxiety or depression, that stems from your physical injuries.

- Property damage: Covers the cost to repair or replace your vehicle or other damaged property. If the payment exceeds the property’s fair market value, the excess may be taxable.

The tax treatment remains the same whether you receive your settlement as a lump sum or installment payments in a structured settlement. The advantage of a structured settlement is that it can spread payments over time, helping with long-term financial planning and income management.

Taxable Damages

While most car accident settlements aren’t taxable, interest earned on a settlement is. Under both federal and North Carolina law, any interest included in your settlement, such as interest that accrues while waiting for payment or that’s added by a court order, is treated as ordinary income. That means you must report it on your tax return, even if the rest of your settlement (for medical bills, lost income, or pain and suffering) is tax-free. For example, if your settlement includes $50,000 in non-taxable damages and $2,000 in interest, only the $2,000 would be taxed.

Punitive Damages

Punitive damages are rare in car accident cases. However, they may be awarded when the at-fault driver’s conduct is especially reckless or egregious, such as in cases involving drunk or intentionally dangerous driving. Under federal and North Carolina law, punitive damages are taxable, except in cases involving wrongful death, where they may be excluded from taxable income.

“Our car accident lawyers have won the trust and respect of clients throughout the state who needed a tough advocate. We have helped countless injury victims navigate the legal and financial hurdles after being involved in life-altering motor vehicle collisions.” – Rhine Law Firm

Contact a Wilmington Car Accident Lawyer for a Free Consultation

If you were seriously injured in a car accident caused by a negligent or reckless driver, you need the services of an experienced personal injury lawyer at Rhine Law Firm, P.C. Schedule a free, no-obligation consultation today. We can recommend a tax professional to help structure your settlement in the most tax-advantaged way.

About Us

Rhine Law Firm, P.C. serves clients throughout North Carolina and nationwide, specializing in complex civil litigation led by Joel Rhine. With expertise in personal injury, car accidents, property damage, sex abuse, and more, the firm is passionate about taking on challenging cases. They emphasize providing personalized legal representation, prioritizing their clients’ best interests while offering state-of-the-art legal strategies. Rhine Law Firm’s dedicated attorneys enjoy the fight for justice and are committed to guiding clients through complicated legal processes. The firm offers free consultations, flexible appointment scheduling, and Spanish language services.