How to Appeal a Denied Insurance Claim

When your home suffers severe damage, you expect your home insurance provider to pay for repairs, minus the deductible. If they deny your claim, you have the right to appeal the decision. First, you must file a written appeal with your insurer, explaining why the claim should be covered, and include supporting evidence. If your appeal is denied again, you may have further options, including legal action.

When you need to appeal a denied insurance claim under your property and casualty insurance policy, trust a North Carolina property damage lawyer from Rhine Law Firm, P.C. We will ensure all necessary documentation is properly submitted and your appeal is filed on time. Our skilled attorneys are deeply familiar with policy language and the tactics used by insurers to deny or minimize claims.

Understanding Why Your Claim Was Denied

Carefully review your insurance policy, especially the declarations page, which shows the types and amounts of coverage you have for potential damages. Next, look closely at the denial letter, which explains why the insurance company rejected your claim and cites the policy language supporting that decision. If you disagree with the reason for denial, prepare to file an appeal immediately.

It is essential to note that homeowner’s insurance policies typically do not cover flood damage. Flood insurance coverage is available via the National Flood Insurance Program,

Common Reasons for Denial

The most common reasons for denial include non-payment of premiums or failure to report the damage by the required deadline. Most policies require policyholders to give ‘immediate’ notice of a loss and generally allow up to 60 days to submit a signed proof of loss. If your claim is denied for one of these reasons, your attorney can review your policy and circumstances to determine whether an appeal is possible.

Other reasons for denial include:

- Insufficient coverage: The policyholder did not have enough coverage for the type of damage claimed. For example, a homeowner may have dwelling coverage that pays for roof repairs after a hailstorm. However, if wind-driven rain enters through pre-existing cracks or poor maintenance issues, the insurer may deny coverage for the interior damage.

- Insufficient documentation: Insurers make decisions based on the quality of the evidence. A homeowner cannot simply claim a certain amount of damage without presenting strong evidence. The more thorough your documentation, the more likely a claim will be approved.

- Misrepresentation: Policies are generally void if there is any fraud or misrepresentation on the homeowner’s part. For example, if they fail to disclose that a wood stove or fireplace is in use, the insurer may later deny a fire damage claim because the risk was misrepresented.

- Not Meeting Policy Requirements: Insurance policies often require homeowners to comply with certain obligations, such as paying premiums on time, keeping the property in good repair, or submitting a proof of loss within the required deadline. If these requirements are not met, the insurer may deny the claim.

- Not Mitigating Property Damage: After a disaster, homeowners must take measures to mitigate further loss. Failure to do so results in even more damage, which can cause claim denial.

- Pre-existing conditions: It is the homeowner’s responsibility to keep their dwelling in a safe condition. If the insurance adjuster suspects that the damage is due to negligence or existed before purchasing the policy, the claim may be denied.

- Policy exclusion: As noted, flood and earthquake damage are excluded from standard policies. Individual policies may have certain exclusions.

While insurance companies may cite many reasons for denying a claim, not all denials are final. Some are based on technicalities, unclear policy language, or errors that can be challenged.

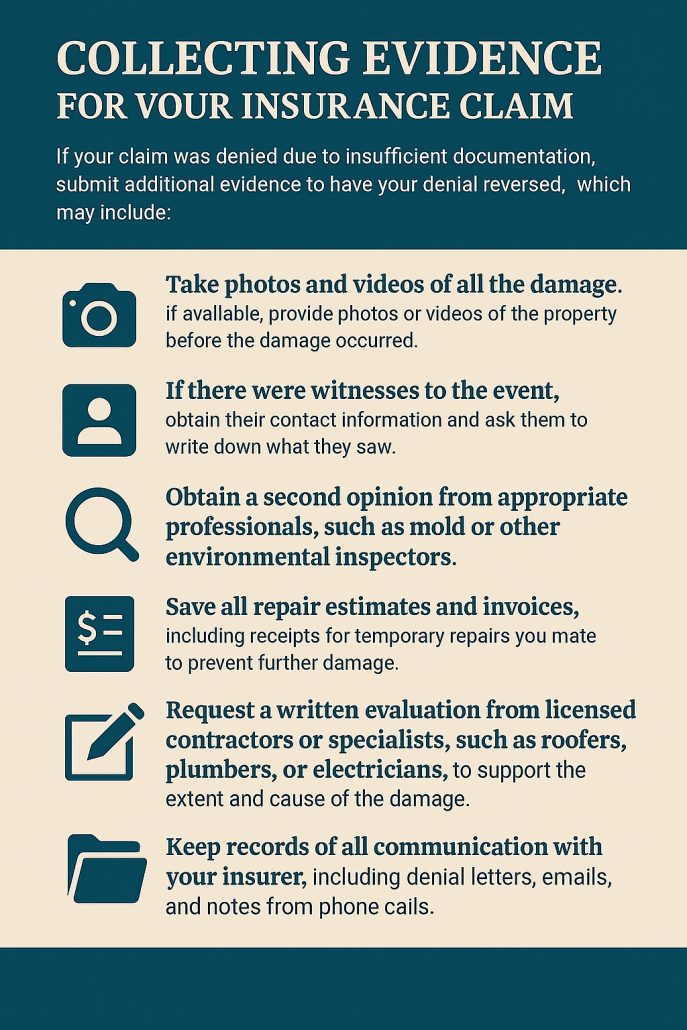

Collecting Evidence for Your Insurance Claim

If your claim was denied due to insufficient documentation, submit additional evidence to have your denial reversed, which may include:

- Take photos and videos of all the damage. If available, provide photos or videos of the property before the damage occurred.

- If there were witnesses to the event, obtain their contact information and ask them to write down what they saw.

- Obtain a second opinion from appropriate professionals, such as mold or other environmental inspectors.

- Save all repair estimates and invoices, including receipts for temporary repairs you made to prevent further damage.

- Request a written evaluation from licensed contractors or specialists, such as roofers, plumbers, or electricians, to support the extent and cause of the damage.

- Keep records of all communication with your insurer, including denial letters, emails, and notes from phone calls.

Our team can help gather, organize, and present this evidence in a way that strengthens your appeal and gives you the best chance of overturning the denial.

Contact a Wilmington, North Carolina Homeowners’ Insurance Lawyer

If your property damage claim was denied, or if there was a denial of a personal injury claim after an accident, schedule a free, no-obligation consultation today at Rhine Law Firm, P.C. Since time is of the essence in filing an appeal, contact us as soon as possible after receiving the denial letter. We will evaluate your situation and the extent of your losses and let you know your options.

About Us

Rhine Law Firm, P.C. serves clients throughout North Carolina and nationwide, specializing in complex civil litigation led by Joel Rhine. With expertise in personal injury, car accidents, property damage, sex abuse, and more, the firm is passionate about taking on challenging cases. They emphasize providing personalized legal representation, prioritizing their clients’ best interests while offering state-of-the-art legal strategies. Rhine Law Firm’s dedicated attorneys enjoy the fight for justice and are committed to guiding clients through complicated legal processes. The firm offers free consultations, flexible appointment scheduling, and Spanish language services.